Here’s The NEW WAY To Unlock The Explosive Power Hidden In Your IRA And 401(k) Money To Build A Better Future.

…Even if you have no idea what investments

you should buy in these weird times!

Dear Friend,

This letter is about a completely different approach to taking control of your IRA and 401(k) money that eliminates the need to “pick the winning horse” in our unpredictable economy, eliminates the need to spend hundreds of hours “due diligence-ing” investment deals, eliminates the need to make things complicated and messy, and quite frankly …just may work better than anything you’ve ever seen.

“Is It IMMORAL To Access Your Money So Easily?”

I almost fell out of my chair when he asked me that.

The guy was an executive for a Self-Directed IRA custodian company and his job was to sell horribly limiting custodian accounts to naive investors who didn’t know any better.

We were talking shop and after a great deal of prodding from him, I’d finally showed him under the hood of the my IRA/401k system that he was sent to investigate.

This system had already “unlocked” hundreds of millions of dollars of people’s IRA/401k money, and the cost of using it was peanuts compared to what he was charging his poor clients.

Here he was charging millions of dollars every year to investors who rarely (if ever) saw the kind of IRA/401k results they hoped for …and my little homespun creation had rendered his entire corporation (and dozens just like it) completely obsolete.

He was shocked, flabbergasted, skeptical, and desperate to know more.

It Started With A Discovery

I Made Eight Years Ago

I was 24 years old, and was looking at early retirement because I’d just finished selling all my investment properties I’d worked hard to acquire. I saw the real estate bubble burst coming and took action to avoid getting slaughtered.

I was in a great place financially, but the road that got me there was completely crazy!

Peeking behind the curtain of the investment industry showed me just how crazy and full of liars it really was. They thrived on an uninformed public.

I found out that most people don’t even know what an IRA is capable of doing… not the financial planners, bankers, real estate agents, gold brokers, or even the IRA custodians.

They were all so busy focusing on their own success, nobody ever bothered to piece all their information together and ask “how can this benefit the investor?”

You’ll never believe how much this can cost you—and how much money you can save and put right into your pocket by kicking out the greedy sharks currently frenzy-feeding on your IRA and 401(k) accounts out back—while a salesman in a suit out front distracts you with glossy brochures, statements, reports, charts, news channels and ANYTHING to keep you from peeking around back to see what’s really happening to your 401k/IRAs.

“Um, sir, you can’t go

through that door.”

Well I say, c’mon let’s have a look.

First off, I’ve got to point out that the worst way a person could invest in Wall Street is by buying mutual funds. And that happens to be exactly what almost every IRA or 401k is forced to invest in.

Through a series of new studies, it’s been revealed that the average mutual fund charges about 3.5% in annual fees per year… with only a tiny fraction of that being properly disclosed to the investor.

Meanwhile, 94% of mutual funds fail to meet their benchmark goal, which is to perform as well as the “stock indexes” that you can buy without their hefty fees.

*** Look, I know you might be thinking “Jeff, I already know this and I’m thinking of investing outside of the publicly-traded stock market.” If that’s you, this part will especially tickle your fancy—Keep reading…

So to put it directly, mutual funds charge exorbitant fees in exchange for providing worse performance.

Just HOW MUCH Are

They Taking From You?

Check this out…

[numeric examples, TPFD]

“Get Me OUT Of Here!”

It’s enough to drive you mad… which spawns a whole industry of alternative investments.

These are people who will sell you real estate deals, physical gold and silver, private lending contracts, hedge funds, and a whole array of investments that you can buy with your IRA/401k money—IF you setup an account with a Self-Directed IRA Custodian.

…That’s a company that gives you a different type of IRA where they will administer the money transfers for many alternative investments.

For example, they can handle your IRA money buying an investment property.

Which brings me to….

The Dirty Secret of The

Self-Directed IRA Custodians

These corporations exist primarily on web sites with back offices of paper pushers in cubicles and a few cushy corner executive offices.

Behind all their fancy web pictures of actors, working hard acting like happy retirees—ironic—is the truth that 9 out of 10 Self-Directed IRA investors are blocked from having the success they desire.

You read that right. Nine out of ten Self-Directed IRA investors fall flat on their face doing exactly what they thought would be better than staying in the shark-infested “Standard IRA/401k”.

After meeting and/or consulting with THOUSANDS of Self-Directed IRA investors, I can boil it down to 4 “traps.”

4 Traps That Block Self-Directed

IRA Investors From Winning

This is almost like a gauntlet, and unfortunately, I’ve seen some investors work brutally through each stage over a period of years—or even decades—with only a few coming out the other side to any measure of real happiness or success.

The good news, all of that pain and misery can be avoided by learning from others’ mistakes and just steering clear of these traps.

Trap #1: Stuck In Limbo

Believe it or not, the majority of Self-Directed IRA investors never get past this first trap. Here’s how it happens…

- The investor opens a Self-Directed IRA account, with plans to invest in alternative assets

- He transfers money into his new Self-Directed IRA from pre-existing IRA/401k accounts

- That’s it

Seriously, that’s all. Some people don’t even get Step 2 done. How does this happen to so many investors?

They just don’t pull the trigger on an alternative investment. Sometimes that’s a good thing, especially if their gut was warning them not to do it.

The result? They end up with all their money sitting in the Self-Directed IRA, earning zero [or nearly zero] interest, wasting away to inflation.

Or worse, if they never completed the funds transfer, they’re just paying for account fees every year while their real money is still getting devoured back in their shark-infested Standard IRA/401k where they left it.

What’s shocking is that the other traps are even worse.

Trap #2: Going “All In”

It looks really great on the movies. The guy boldly pushes all his chips into the middle of the table. Dramatic music. Sometimes, the story ends in a massive triumph; other times in tragedy. But the credits roll and you go home to the real world.

And in the real world of investing, there’s no credits or starting over. You have to live with the results you get.

For Self-Directed IRA investors, this move isn’t usually made to be stupid, but to be practical.

Think about it. The average share price in the stock market is $67. But if you’re buying HOUSES for investment, for instance, the median home price is $188,900.

And an apartment building? Probably $2 million. Even many hedge funds require a minimum investment of $1 million or more.

Naturally, this leads to many Self-Directed IRA investors “going all in” simply because of the minimum investment size.

Now, I don’t have to tell you how bad that can turn out. Everyone knows not to put all their eggs in one basket. But no matter how risky it seems, some people are so fed up with Wall Street and yearning for a change, they do it anyways.

And just like on the movies, sometimes it works out, sometimes it doesn’t. But the credits don’t roll, real life just goes on.

This “All In Trap” often creates even more financial and retirement anxiety because the money gets stuck in the investment, leaving the investor to “hope” as they continually try to figure out whether it’s going to weather the storm of the rumbling, changing economy.

Trap #3: A Disintegrated Mess

This happens to the investor who:

- Opens a Self-Directed IRA

- Transfers money into it

- Makes an investment

This is what most investors forget to think about. After you’ve made an investment, and avoided the “all eggs in one basket” trap, that means you’ve got money left over. What do you do with it?

If it sits in the Self-Directed IRA account, getting zero or practically zero interest, you’re burning up your future.

I don’t want to insult your intelligence—I think you already know you have to grow your money or you get eaten alive by inflation.

If your lifestyle costs $50,000 today, in 20 years it will cost you $90,305 per year with only 3% inflation. You have to grow your money.

Even if you put the leftover money into a few more investments, it won’t do you much good if it’s in the same “basket.”

Whether you own 3 rental properties, 3 tax liens, or 3 pre-IPOs… you’re still un-diversified.

But let’s say you really do mix things up:

- A rental property

- A pre-IPO

- Some physical gold and silver

Then you’ve just fallen right into:

Trap #4: Stuck In First Gear

As exotic as that kind of portfolio might sound, it still has some crazy risks and doesn’t even begin to tap into the full power of an IRA or 401k.

Take Billy for example. He setup a Self-Directed IRA right after the 2008 crash. Which was smart.

Unfortunately, because he moved all his IRA’s $300,000 to his Self-Directed IRA, he totally missed out on the bull market in stocks. If he would have had even half of his IRA money still able to access the stock market, he’d could be sitting on an extra $387,000 in hard cash today.

Billy had just traded one set of limitations for another. That’s because he didn’t know about…

The Secret Document

That Clears All The Traps

All of these tales of Self-Directed IRA Investor woes have an underlying invisible element tying everything together behind the discombobulated mess.

Different kinds of accounts, LLC, multiple custodians, multiple IRAs, Roths… all withholding the one document that can set you free.

This document entitles its holder to control the IRA, set its limitations, control its choices, control its fees, and basically run the show.

It’s a real document. There are over 100 million Americans have these accounts—and there’s a document behind each account, so taboo and powerful, nobody even talks about this.

It’s called the “plan document” and if you want to solve this puzzle, repeat after me:

“He Who Holds The Plan

Document Controls The IRA”

This is the big secret sauce that unlocks the full power of the IRA/401k. But instead of sauce, it’s a document.

If this master document is in your file cabinet, you’re a “free agent” and the world is your playground as a smart investor.

Let this document be locked away in some cushy corner office of a Self-Directed IRA Custodian executive, and say goodbye to your dreams.

That might sound dramatic, but consider this…

XX Powerful Reasons To

Become A “Free Agent”

Compare this to Frank, an investor who did almost the exact same thing as Bill, but as a “free agent”…

Frank fully unlocked the power of his IRA, held his own plan document, and became a “free agent.”

This enabled him to make all the choices he had never even known about:

- Where to open accounts

- Which taxes to legally avoid

- Avoid all of the 5 deadly SDIRA Investor traps

Let me show you:

[illustrations of taking the controls, and the relation of the plan document vs. the discombobulated way]

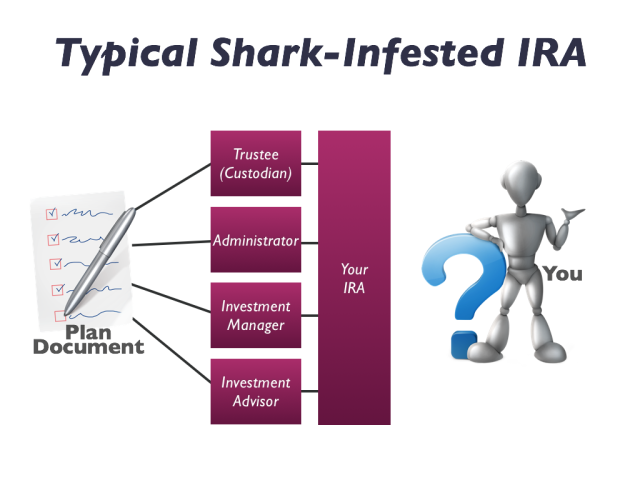

In this typical shark-infested Standard IRA, putting the plan document on THEIR side locks you in to their THEIR family of mutual funds that enrich them—to the tune of XX% of your money!

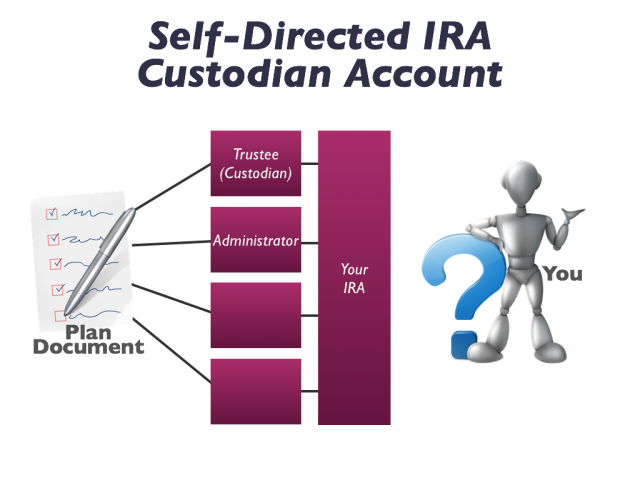

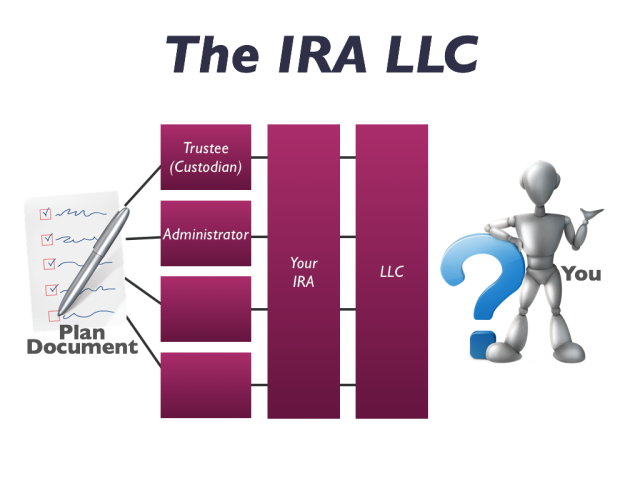

Sadly, the very solution proposed to offer investor freedom—the Self-Directed IRA Custodian account—looks like this…

Notice how the plan document is still nestled conveniently on the other side? That’s so you’re locked in to what THEIR plan document says.

It’s basically a monopoly, and swapping a Standard IRA for a Self-Directed IRA is just like changing the facade—but it’s still a monopoly, and the full power of the IRA/401k is still locked away out of your reach.

That’s what Bill discovered: his Self-Directed could never give him the option to legally opt out of double taxation on his real estate.

That’s just one of the many problems, in addition to the 4 deadly traps I already showed you, that comes with your IRA plan document being out of your reach, under their power. They’ll use it to enrich themselves, at your expense, every single time.

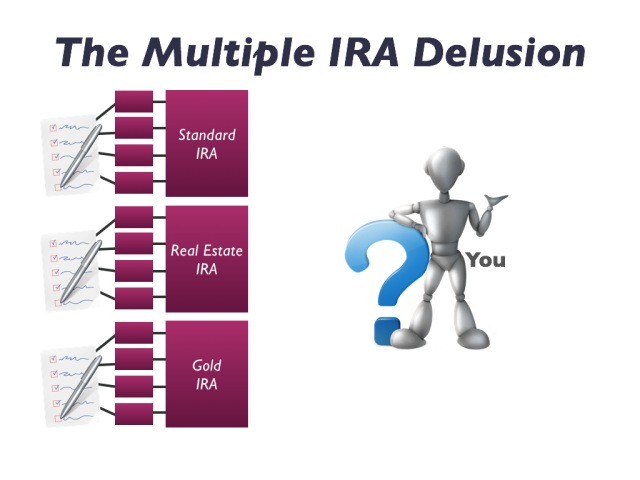

So what do most investors turn to?

It’s an attempt to get that elusive “free agent” status where all the monopolies, restrictions, and limitations are replaced by true freedom.

…But it just doesn’t work, and it’s all because the plan document is still on the wrong side. Remember, “He who holds the plan document controls the IRA.”

Before I show you the problems the multiple IRA approach is ridden with, it’s important I address a question you may have…

What About The

Self-Directed IRA LLC

or “Checkbook IRA”?

The IRA LLC was a big innovation. In fact, I thought we’d found it.

Debra Buchanan and I pioneered that thing back in the early 2000s. The IRA LLC was a massive improvement upon the Self-Directed IRA… but investors still seemed to have all kinds of painful problems and unpleasant surprises.

You see, the IRA LLC is like a response to troubling symptoms, without taking a hard look at the underlying cause.

Self-Directed IRA investors would complain:

- “My custodian takes forever to process my requested transactions”

- “My custodian isn’t allowing the investment I want to do, even though it’s 100% legal”

- “My custodian charges me too much money”

- “Why am I paying to have yet another company limiting my IRA?”

These kinds of complaints are valid and certainly frustrating.

Imagine yourself faced with paperwork for a safe and lucrative investment and you can’t sign it directly and your custodian refuses to sign it.

That’s every day business for a SDIRA custodian company. Their business model is so mired down by paranoid attorneys who won’t let them let their customers experience the true power of an IRA. They’re afraid of law suits.

And they should be…

Self-Directed IRA custodians

get sued all the time

An with each passing year, they get more and more restrictive and their accountholders get less and less power and control over their own IRA money.

It’s infuriating, and I’ve had my share of emails and phone calls from investors letting off steam about how inadequate their Self-Directed IRA Custodian account is, and how they’re even questioning whether any of their effort was worth it.

Many of them would setup an IRA LLC in search for more freedom…

This structure addresses some common complaints, but I bet you noticed where that plan document is located, haven’t you?

On the WRONG side, again.

Terrible Danger On The Horizon

Meet Bill: An investor who, like many, decided to make a change with his investments. In his case, he decided to invest in real estate to see if he could make good profits and have more control over his future.

Bill couldn’t have executed his plan any more perfectly on the real estate front. He built a portfolio of rental properties that paid his IRA over $40,000 per month in cash flow.

It was a big accomplishment, and he was happy with his progress… until the first tax bill came.

To Bill’s astonishment, his $40,000 per month in real estate income was racking up

[UBIT example]

He Got Double Taxed at 39.6%!

…Plus an extra 11.3% tax from the state of California where Bill lives!

Why? Because Bill didn’t hold the plan document and had no say in the matter.

Plus…

FACT: The IRA LLC Is Complicated

Most investors who get to this point just pay a “facilitator” firm, often made of up attorneys originally taught by me or my students, who will then do everything to setup this IRA LLC for them.

They end up getting a notebook full of documents in the mail, but even if all the documents have already been prepared, the complexity of the approach doesn’t go away.

There can be:

- Extra tax returns

- Extra taxes

- “Franchise fees” to state governments

- Fees, fee increases, policy changes, and interference from the IRA custodian

Yep, that’s right… no surprises here, the IRA is still LOCKED no matter how complicated it’s made to be.

It’s because the plan document is still out of your reach and belongs to someone else—the IRA custodian corporation—naming themselves as the true controller of your IRA and changing the rules at their whim without having to ask you.

Don’t expect to find this fact on their web sites though. Just lots of pretty pictures. It’s all rainbow and unicorns… until your account’s opened, locked in with them, and you try to invest with it.

If I’ve accomplished one thing with you so far, I hope it’s to simply help you to avoid falling into the same traps thousands of others have fallen for. Now let’s talk about…

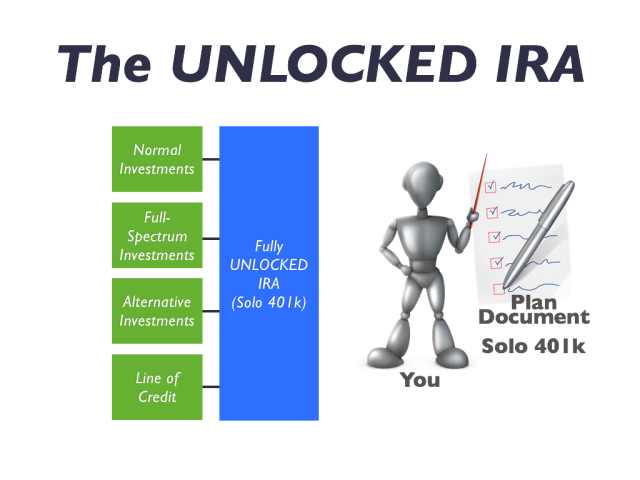

How To Get The Plan

Document In YOUR Hands

This is where things get refreshingly simple and for a good reason.

The one and only way to get your IRA plan document in your hot little hands is to setup a special type of IRA.

In fact it’s called a “Solo 401(k)” because of a legal technicality. But make no mistake, it’s an IRA.

It’s more of an IRA than any other IRA—setup by you, for you, giving you complete control in a way none of the other approaches can deliver on.

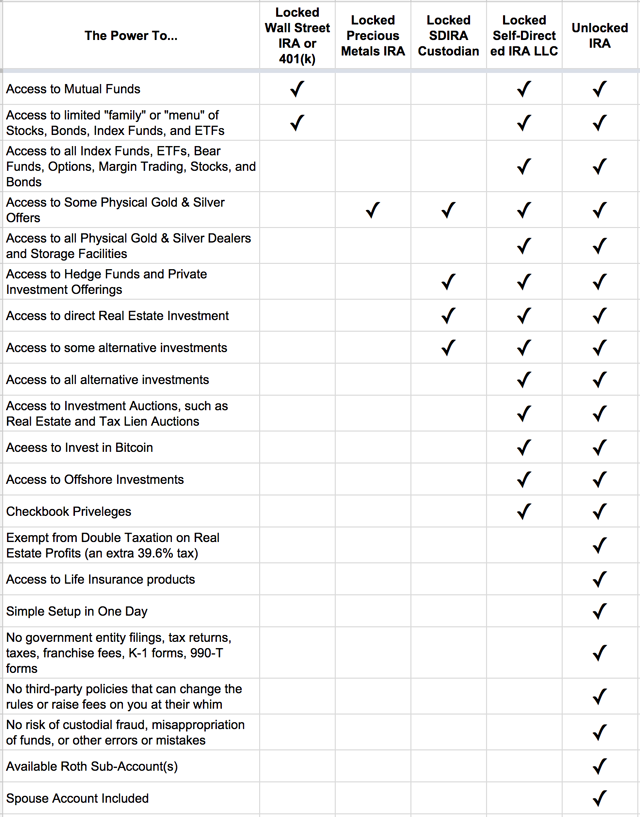

Have a look for yourself at what’s possible:

And it’s all possible because of…

…You guessed it: The plan document is on YOUR side.

Who would have ever imagined putting a document in your filing cabinet could make such a big difference on the control you have over your money and future?

Having the plan document on your side means that ANY element of your IRA is up to your choice and control.

Want to change physical gold storage facilities? You have the power.

Want to change who you use for stocks, bonds, and index funds? You have the power.

Want to invest offshore? You have the power.

And you can do all of this WITHOUT breaking or even bending any rules. This freedom comes from UNLOCKING that plan document and putting it on your side.

In fact, when you have the plan document you aren’t even required to hire any of the custodians who want to charge you money to take away your control.

This makes you a free agent. Even free to…

Invest In A REAL

Brokerage Account

Now let’s talk about Wall Street’s best kept secret.

That shark-infested, mutual-fund-laden, high-fee, ripoff “Standard” IRA is locked up in a limited “family” of funds and investment choices designed to enrich the administrators, custodians, and brokers involved in monopolizing on your IRA money.

But when you use a Solo 401k,

it’s not THEIR IRA—it’s YOURS.

Let me explain because this could be worth millions of dollars to you and your retirement…

Most investors are so suffocated by bad IRAs because the plan document is setup automatically without your input. That’s how they get all the limitations (about forcing their family of high-fee mutual funds, disallowing alternative investments) in there.

The key to UNLOCK your IRA money is to go from the old way:

Step 1: Open Your Account

Step 2: Invest Among the Options Made Available To You

…which by the way is the same process whether you have a Standard IRA or Self-Directed IRA…

Instead, to fully unlock your IRA money, you make one simple change:

Step 1: Setup Your Plan Document

Step 2: Open Any Accounts You Want

Step 3: Invest Among Any Option Out There

In other words, you just separate out the creation of the plan document and the opening of accounts.

In fact, you can open a REAL brokerage account that gives you access:

- Nearly-zero-cost index funds that outperform mutual funds with 90% less fees

- Stock options (puts, calls)

- Margin accounts

- Bear funds (make money with the stock market goes down)

- All available publicly traded stocks and bonds

Why This Is Important

(And Valuable)

Remember deadly trap #1 I told you about earlier? Many would-be Smart Investors are stopped in their tracks by uncertainty…

- What should I invest in?

- Should I really get out of the stock market?

- What do I do until I find a suitable alternative asset investment deal?

- Am I really cut out to make decisions on alternative assets?

- Do I have what it takes?

You see, they feel like they need to be switching from “Team Wall Street” to “Team Alternative Assets” and it causes them to freeze up in doubt, or even reduce their own power and choices.

With a Solo 401k, fully UNLOCKED, there’s no choice to make: you get it all.

In fact, you can start with the simplest, easiest investment strategy ever: buy index funds that outperform your old IRA/401k, and reclaim the 60% of your money that you were losing due to be robbed through fees.

Anyone can do that.

Let me show you how easy it is with the Solo 401k system I built…

Step #1:

Create Your Plan Documents

After typing in your name, address, and other basic information into our Solo 401k System, you’ll be able to download your IRS-approved plan documents, making you a Free Agent once and for all.

Just put this document in your file cabinet and say “Never Again!” to being hoodwinked by the greedy sharks and their monopolistic system.

When you close the drawer to your home filing cabinet, you’ll hear the sound of a good decision.

Step #2:

Choose Your Brokerage Account Provider

Because the “qualified” nature of your Solo 401k is sitting in your home filing cabinet, all you’re doing for Step 2 is opening a brokerage account at the provider of your choice.

I’ll give you my recommendations on the best brokerage providers that are the easiest to deal with and have the best options and service.

Step #3:

Transfer Your Money (Tax-Free)

This is where you just move the money from your other IRA, 401k, 403b, and 457 accounts into your Solo 401k. They’ll actually send you a check, made out to YOUR Solo 401k for you to deposit at your brokerage account.

With my cheat sheet and transfer guide, you’ll learn how to avoid common transfer pitfalls and ensure your money transfers smoothly.

When following the guidelines, your transfers will be tax-free and you can make as many as you want. These days, you can transfer just about any retirement account into your Solo 401k.

The only exception is Roth IRA money can’t be transferred in, but Roth 401k money can.

Step #4:

Setup Your Portfolio

Even if you never even dabble into alternative assets, you’ll enjoy the full-spectrum of publicly-traded investments.

The world is your oyster when you toss the junky funds and take advantage of accessing all index funds, ETFs, bear funds, stocks, bonds, options… and you can even use margin.

This is where you reap the benefits of controlling and possessing the Solo 401k plan document because it says you can do all these things. They’re all legal, and now you have the freedom that comes only with a fully UNLOCKED Solo 401k.

Feel free to hire a registered investment advisor to help you. You can even pick one that’s a fiduciary to you and doesn’t accept commissions from the sharks.

Even if you never progress pass this step, and you did nothing other than hold a portfolio of index funds… you’ll enjoy [historically] much better performance, and recapture 60% of your money that was going to high fees.

That in and of itself can make or break or your retirement. It’s so easy, anyone can do it.

Step #5:

(Optional) Buy Alternative Investments

You can do this instantly with the “checkbook privileges” granted by your Solo 401k.

Whether it’s a real estate deal, buying physical gold and silver, storing gold and silver at a professional insured storage facility, buying tax liens at auction, buying pre-IPO stocks or investing in venture capital funds, joining lending clubs, buying bitcoin—or ANY other investment opportunity you can find out there—you have the full freedom to invest.

You’re restricted from investing with family and from “conflict of interest” or “self dealing” transactions, but these are simple to steer clear of and I’m going to give you a full report (no charge) of how to avoid these.

Step #6:

(Optional) Shelter Massive Self-Employment Income From Taxes, If Applicable, Up To $115,00 Per Year

This is for self-employed people who are high earners. The Solo 401k can accept tax-deductible contributions MUCH higher than any IRA can.

If you’re a big earner with self-employment income, this alone can put millions of dollars in your pocket, every decade.

Okay, by now, you’re probably wondering…

Why In The World Doesn’t Every

Investor Have A Solo 401k?

Good question. It’s because you have to qualify for this.

There’s just one “prerequisite”… you have to have a “qualifying business activity.”

This Is Trap #6

And it goes something like this…

“The Solo 401k sounds great, but I just don’t have a business.”

Most “Experts” Will Steer You

Right Back Toward an IRA LLC

This topic is very misunderstood. It would be very misleading to say “the Solo 401k isn’t for you” just because you don’t have a business.

A business, in general, is something that’s incorporated with attorneys, paperwork, tax returns, startup costs, operating costs… and lots of other headache and obligations.

On that note, the Solo 401k does NOT require you have a business.

It requires you have a “qualifying business activity” which is very different. More on that in a moment.

In fact, you probably already have a qualifying business activity and you just don’t know it.

A qualifying business activity can involve none of those burdens or headaches and require as little as only a few hours per year.

If you don’t already have one, that’s okay too. I’ve helped thousands of people generate “qualifying business activity” without spending a dollar.

It’s more about overcoming the intimidation of the IDEA of a business and distinguishing for yourself that generating a “qualifying business activity” is fairly painless.

The actual steps to generating it are simple.

And you don’t have to wait to setup your Solo 401k either.

Employers Prohibited: If you a own a business that employs other people FULL-TIME who get a W2 paycheck, the Solo 401k isn’t available to you. (If that’s you, don’t worry, there’s something similar to a Solo 401k that works for you, just email us to request info).

And You Can Do This WITHOUT

Adding A Single Dollar In Fees

You’re an investor, so I know your concerned with the bottom line. Or the “net” result of how much something will cost your or how much profit it will bring you.

The beautiful thing about replacing your “Standard” shark-infested IRA with a Solo 401k is that you’re ELIMINATING the biggest cost: the hard and real cost of being forced to choose from a “family” of high-fee funds designed to scrape your account every year.

And remember, on average, these funds are 3.5% per year. That’s $3,500 every year on a $100,000.

Or $35,000 per year on a $1,000,000 IRA.

It Doesn’t Cost $35,000 (Or Even $3,500)

Per Year To Be a “Free Agent”

As you’ve learned, the key is in setting up your own “plan document” to establish your Solo 401k.

You should know that such an endeavor CAN cost tens of thousands of dollars if you go to an attorney.

But luckily, the IRS has actually made things cheap and easy on us for once. Set aside the complaints (no need to preach to the choir here) about the IRS and look at the silver lining:

The IRS has programs in place where a “plan document” can be provided for you that is automatically “qualified” as a true Solo 401k and entitled to all the tax benefits and legitimacy. You even get an IRS certification and document serial number.

In fact, eight years ago I did just this for some of my consulting clients back then. I hired the attorneys to setup the Solo 401k plan document to create absolute freedom—a true Free Agent status for anyone with this plan document in their hands.

The plan document is just part of my total Solo 401k System which is totally free for most people.

How It’s Free

This isn’t rocket science. Save $3500 in one place and spend it in another and you have a net cost of zero for making that change.

And that’s exactly what we used to do. It would cost you $3500 to setup your own Solo 401k, but instead of that fee every year like a Standard IRA, you’d only pay it ONCE, never again to be repeated.

More Free Than Free

As if it’s not already a good enough deal to pay a single “exit to freedom” fee to unlock the full power of your IRA and 401k money, you don’t even need to pay that fee.

Why? Well, I’ve been sitting on my Solo 401k system for years because I retired quietly to a nice home on the 10th hole of a golf course in sunny Scottsdale, Arizona.

But I still get voice mails and emails every week of people who have heard through the grapevine:

“Jeff, how can I get access to your Solo 401k? I’ve heard it’s the ultimate Unlocked IRA… Where do I sign up?”

I Felt Terrible

(My Guilt = Your Savings)

…Because I haven’t been responding to any of these inquiries. After a while, I could hold out any longer.

I wanted to say “I’m Sorry!” that this hasn’t been available; let me redeem myself to you.

So to do that, I’ve decided to completely wave the $3500 Solo 401k setup fee and give you instant access.

All that’s left to pay is the measly “annual maintenance fee” required by the IRS for me to keep my Solo 401k document system up to snuff each year—and thus keep your Solo 401k plan document up to date as well.

That’s just a flat $347 per year. So obviously cost isn’t an obstacle or issue for you here.

It’s more of a question…