- Don’t call or write your Senator or representative

- Don’t sign any petitions online

- Don’t join a consumer advocacy organization

Our government is not one for the people anymore, and we must oppose the bailing out of failing, irresponsible, fraudulent corporations.

Reasons to vote against the bailout

- The corporate officers who made the decision to pursue short term profits at the cost of later bankruptcy often received tens of millions of dollars in bonuses and dismissed adequate warnings from advisers about the future consequences of their decisions.

- Bailing these companies out is a reward for behaving dishonestly, unethically, and fraudulently.

- If running a company into the ground is rewarded with free money, then this puts sound-minded companies in a position of competitive disadvantage.

- This would create new rules of business: If you are a small company, you must follow sound-minded practices to thrive; if you are a very large company, destroy your company and it will be rebuilt at the cost of American taxpayers.

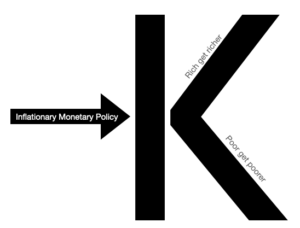

- Bailouts are requiring the Fed to create an extraordinary amount of new money which throws fuel on the fire of the already double digit inflation. Runaway inflation steals wealth from citizens to give it to the banking system and the government.

How do I vote against the bailouts?

Because our system of local government has been replaced by central federal government, there is no longer any official way to make any sort of vote actually count on most matters.

What you do have is your money. Every single day in which you leave any money in American banks and American securities brokerages, you are supporting the system that is looting you and your family. Every day in which you wake up and make no changes is another self destructive vote in support of our failing banking and economic system.

Transfer your cash to foreign bank accounts

The only reason any American person would not make use of foreign bank accounts is because they think they may be less secure. As we enter into the final quarter of 2008, this is no longer a legitimate reasoning. Every fact available to us today tells us that the US banking system is currently among the most unsafe places to hold cash and other assets in the entire world of developed countries.

Foreign banks have internet banking, Visa/MasterCard debit cards, wire transfers, check writing privileges, and just about every other convenience you have become accustomed to. You won’t be able to go into a branch, but virtually all transactions will be able to be completed using the telephone and internet.

Liquidate most U.S. securities holdings

While there may be some tremendous opportunities in the U.S. securities markets during this turmoil, modern portfolio theory would suggest you only apportion a small slice of your investable assets into such speculative and risky positions.

Stay away from U.S. securities in general. Owning shares of any mutual fund, index fund or major corporation that sells a product or service to U.S. consumers or businesses will probably be a losing bet for many years to come.

Your vote will be heard

Every dollar you deposit into a U.S. bank is lent out many times to somebody else. Often times that borrower then deposits the money into another U.S. bank, thus perpetuating an endless cycle of debt.

There is an abundance of U.S. dollars in our economy right now… the problem is that most of them are borrowed instead of earned. Consumers and businesses (including banks and brokerages themselves) have had tons of money in their hands, but most have never come up with a way to earn the income to pay back the principal and interest. It’s a recipe to losing all equity in property.

It’s time to restore this country to enable the American dream. The American dream involves property ownership. American businesses and consumers own almost no property in today’s debt-focused economy. Every piece of real property, personal property, and intellectual property is leveraged to the hilt with debt. Taking on debt is something you do when you expect a rise in income, but American consumers and businesses have begun to treat loan proceeds as if they are income… and that can only lead to bankruptcy.

If you don’t VOTE NO TO BAILOUTS now, the elements of honesty and trust will forever be breached within our financial system.

The consequence of no action

Our financial system will be increasingly unpredictable. In this type of environment it will be difficult to place your wealth in a way where it will securely grow. You may make an investment in something that will be severely affected by some sort of intervention by the government or private central bank.

Taxes & inflation will rise dramatically. No action will mean that as time goes by, you will get to keep less and less of every dollar due to rising taxes. To make matters worse, every dollar will buy less and less because of the increasing money supply to feed government spending and corporate bailouts.

The fruits of action

Voting no to bailouts by moving your money to more sound financial systems of other countries will force the U.S. government and banking system to rebuild itself in a way conducive to personal freedom, personal property ownership, and personal sovereignty. The government will have to spend within its means, and this rebuilding can be our opportunity to restore the power of local governments and strictly limit the power of the federal government.

This will create an environment in which fraud will be punished, good businesspeople will thrive, and every American citizen will have laid out before them a simple, attainable path to personal freedom, sovereignty, and wealth.