The K Shaped Economy

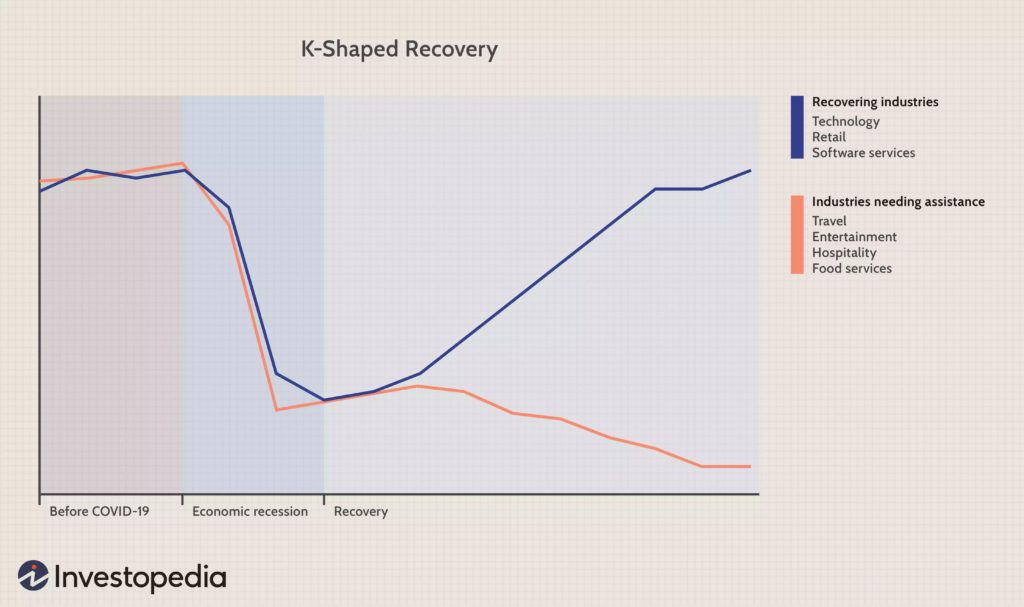

Many have talked about the K shaped economic recovery, in which different sectors of the economy go in different directions:

This is an important observation that leads to a deeper trend: the K shaped economy.

The K shaped recovery draws attention to what’s happening in recent weeks to months. It’s fitting for short attention spans curated by clickbait and the 24-hour news cycle.

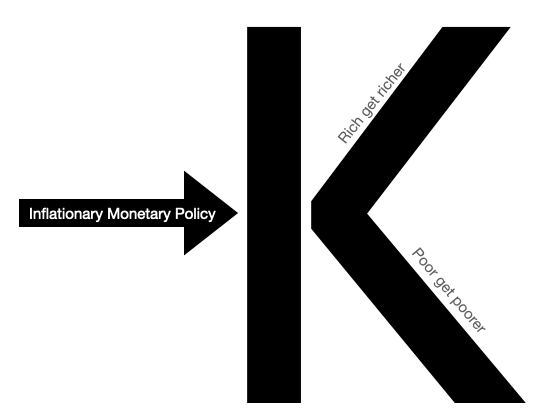

The K shaped economy strikes to the heart of something more important spanning decades: increasing wealth inequality.

Those who own financial assets—the “Upper K”—are benefiting. Those who don’t—the “Lower K”—are working harder and harder for less and less. I wrote about this in my 2009 book 5 Steps to Freedom.

The Root Cause Is Monetary Policy

Even the Federal Reserve itself has researched the topic and concluded as such in its recent staff report. Highlights (or lowlights):

- 10% of households (what I call Upper K) own 75% of wealth.

- a 100 basis point change by the Fed 80% of the benefit goes to the top 5% (Upper K) of households. 50% goes to the top 1%.

The report itself focuses on racial inequality—which is real—yet the the Lower K masses are affected the same regardless of skin color.

The Cantillon Effect refers to how asset owners benefit from money printing, due to the injection of money ending up in assets. The Fed soaks the banking system in reserves, which increases asset prices for two reasons:

- It creates optimism in investors by signaling that the Fed will stop at nothing to keep the system going.

- It increases risk taking behavior because nobody wants to hold cash when inflation expectations increase.

Upper K asset owners get increasing wealth from the Cantillon Effect. Everyone else are Lower K, with living expenses outpacing incomes.

What’s an Upper K To Worry About?

Short term thinking and lack of compassion cause many Upper K’s to think “this isn’t my problem.” Oh, but it is.

The Lower K are getting a raw deal and won’t turn the other cheek forever. Continuing the K Shaped Economy could lead to predatory taxation or even violent revolution.

We need to heal the deep problems in our economy and society. Awareness of the K Shaped Economy as well as its root causes and implications is just the start.